I have been freelancing on and off for the larger part of five years, and when I hit 30, I knew it was time to get ahold of my finances.

In my first meeting with Michelle Schaeffer of Gig Serious, a financial consulting firm that helps freelancers and contractors develop systems to manage their money, she asked me to think about approximately how much money I had made the year before. I stared at her blankly.

“I have no idea,” I said. This was the unfortunate truth, and I had to get serious about saving money. Independent contractors need to save at least 30 percent of their income for taxes; because freelancers do not have one single employer, income taxes are not taken out of their paychecks. Half of this 30 percent comes from the self-employment tax which is comprised of 2.9 percent toward Medicare and 12.4 percent toward Social Security. If budgeting for taxes was not enough, I also had to save money in order to wade out from under sizable credit card debt.

Before I could talk about money with others, I needed to first be honest with myself; to do the scary, shameful work of looking at my credit card debt as a whole and devising a plan to tackle it. Once I had an actual dollar amount assigned to my debt instead of the nebulous a lot. of. effing. money, I spoke to several financial experts about ways to save money without thinking too hard about it.

I was not looking for advice like, “freeze your credit card in a block of ice,” which I heard from several sources because while these tactics may work for some, I do not want to approach money as if I can’t control myself around it. These sorts of tips make me feel like I am on a diet, and then all I want to do is eat a frosted carb or, to stick with one analogy, buy copious amounts of scented candles and lipsticks. (I am a real sucker for items that feel luxurious but are in the $30-$40 range.)

I wanted balanced, realistic advice that wouldn’t make me feel deprived or out of control. So I spoke to over 10 experts, and below are the most universally-helpful and easily-implemented pieces of advice I heard.

1. “Put stuff in your Amazon cart. Shop away. But only allow yourself to checkout on each Friday,” says Nicole Middendorf, CDFA and CEO of Prosperwell. If you think of what you don’t spend as money you can put into savings, you may be surprised at how much you are able to save. And if you are prone to impulse buys, know you are not alone in this. One survey found that more than half of U.S. shoppers have admitted to spending $100 or more on an impulse buy. By curbing that impulse, you will quickly save money.

2. “Give gifts of time. Whether it’s for a birthday or Christmas, put a little thought into it and see how you can create a great experience,” says Sean Fox, co-president of Freedom Debt Relief. And often, a gift like this creates long-lasting memories, as opposed to a necklace or piece of technology.

3. “In order to save without noticing it, I leave my credit cards at home when I go shopping to prevent myself from making impulse buys,” says M. Reese Everson, Esq., author of the forthcoming book, “The B.A.B.E.’S Guide to Building Wealth.” “Instead, I take my phone with me and upload the things I want to Pinterest. I then make a monthly budget and decide what I’ll purchase based on my Pinterest post.” Similarly, shopping with a finite amount of cash instead of with a credit or debit card can really help reduce spending. Studies have shown that people spend drastically more money (100 percent more in some cases) when shopping with a card.

4. “Your bank pays interest as an incentive for you to bank with them,” says Greg Mahnken, a credit industry analyst at Credit Card Insider. “If your savings account isn’t making a healthy amount of interest, consider opening a new one. It’s not uncommon to see savings accounts from online banks offering 1-2 percent interest.”

5. One of the best pieces of advice Schaeffer gave me — and this can apply to people with “normal” 9-5 jobs too — is to think of yourself as a business. I opened a separate business account where all my direct deposits go; if you have a steady paycheck, you can still have your paycheck go into a separate account. At the end of every month, I first deduct 30 percent for taxes and pay any business-related expenses. I then “pay” myself the salary I have decided is feasible by moving money from my business account into my personal. Whatever money is leftover goes toward my credit cards.

An overwhelming number of experts also said to invest in a good app (or two). So, I downloaded the Clarity Money app, which links to your bank accounts and gives you a clear picture of your finances each day. It offers a built-in savings account, so each Monday, $75 is automated from checking into my savings account. This account is considered “high-yield,” which means it offers a high-interest rate of 2.25 percent, so your money grows just by sitting there. Brian Brandow of Debt Discipline says, “Having the money out of sight and not in your active checking account will help you avoid spending it. [Put your] savings into an account that is not tied to a debit card, so it takes an extra step to get to the money.” I have found that because it takes 2-3 days to get my money from my savings account into my checking out, I am far less likely to make an impulse purchase, and instead, I can use this savings toward debt.

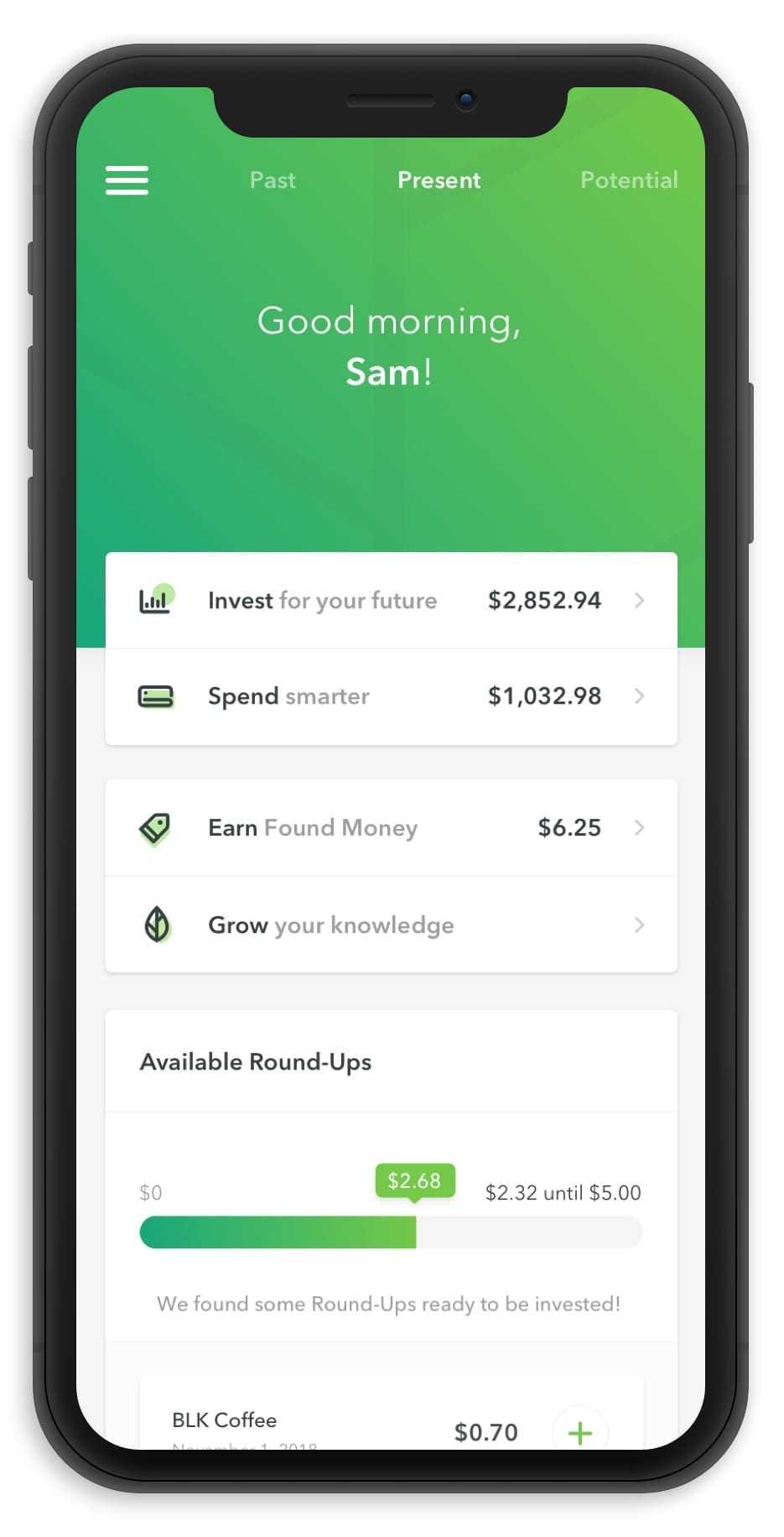

Acorns “squirrels” away from any spare change from a purchase you make and invests it on your behalf. For example, if I were to buy a cup of coffee for $2.50 (and I do still buy coffee out, sue me) Acorns will round my total up to $3, and invest 50 cents for me. Money is invested in exchange-traded funds (ETFs) and according to the Acorns website, the investments “are then diversified across more than 7,000 stocks and bonds and automatically rebalanced when the market fluctuates.” Of all my new finance tactics, this has been the most effortless way for me to save money. I have never noticed the difference in my account, though I now have a chunk invested.

I also try to pick one day each week — the day changes depending on my schedule — where I do not spend any money, not even one dollar. This requires effort and forethought; I buy my bus tickets in advance on those days, make coffee at home, and find free places to work like the local library or a friend’s house. I say no to going out sometimes or suggest a walk instead of a drink if a friend wants to meet up. Or to be realistic, I suggest a walk and then a drink at home from the bottle of wine I bought earlier in the week. Balance, you know.

I wish I had an easy solution. I think, more than any quick tips, it comes down to trusting your ability to make smart financial choices, seeking out the knowledge you need to make those choices, and being willing to exercise will-power. The same logic applies to run a marathon, writing a book, growing out bangs; you have to put in the work and make the sacrifices it takes to get out of debt and save money. Along the way, you wade through the uncomfortable territory, you look at the mistakes you have made and the regrets you have about how you spent your money, and then you forgive yourself and move forward. I have a date marked in my calendar for when I plan to be debt-free. I think I can do it. I think you can do it, too.

We only recommend products we have independently researched, tested, and loved. If you purchase a product found through our links, Sunday Edit may earn an affiliate commission.