I recently read an article in The Cut about a woman, Tori Dunlap, who, by age 25, had saved $100,000 (while earning less than six figures). I regarded this information as one does news that a former classmate has gone on to star in a movie or write a bestselling book: with equal parts awe, resentment, and the feeling that I, too, could save that much money if only I cared to.

When asked how exactly she had saved all that money in just three years, Dunlap said, “I have a six- to eight-month emergency fund that is liquid, about $12,000. The rest of it is invested, either in a retirement account or a non-retirement brokerage account.”

I didn’t necessarily think this woman had a shoebox full of money under her bed, but the fact that her money was invested was not something that immediately crossed my mind.

Then again, my knowledge of investment is … basically non-existent. One of the few things I remember on the topic was my dad driving me to a middle school dance, saying he wished he’d invested in Starbucks earlier, and that I should invest as soon as I started making money. Predictably, as a middle school student on my way to grind to some “Hot In Herre” by Nelly, I just rolled my eyes (and proceeded not to invest until my 30s).

The Cut article got me thinking that I should really start making a long-term investment strategy, and if you’re reading this, maybe you’re in the same boat, so I asked three financial experts for tips every beginner investor needs to know.

Before you can make a plan, you need to decide what it is you’re saving for, and set a goal to get there.

Set A Goal

Before you can make a plan, you need to decide what it is you’re saving for, and set a goal to get there.

“An investor who is putting money away to buy a house in a few years is very different than an investor who wants to save for retirement down the line,” Logan Allec, a CPA and founder of Money Done Right, says. “By taking the time to figure out exactly why you are investing, you’ll be able to invest appropriately and increase the likelihood that you’ll accomplish that goal.”

Decide what it is you’re saving for (or what dollar amount you’re hoping to stow away) which will determine the type of account you’ll set up, the risk level of your investments, and how much time you’ll have.

Do Your Research

Almost every expert I spoke with stressed the need to research before making any large financial moves.

“Don’t follow your gut and do make sure research is your number one reason for anything you invest in,” says Jake Lizarraga, a writer with Real Estate Investment Trusts (REITS) says. “You should be able to answer the question: How much will I get in return for the amount that I put in? You should be relatively confident that there is a minimum you can expect [in returns].”

You should have a solid grasp on how much your money is projected to grow, and how much you can afford to lose without altering your lifestyle.

Some of the books that came highly recommended by experts include:

Don’t Pick Individual Stocks

It can be easy to think: “I like Target and shop there a lot, so I should buy their stock”, but it’s actually better not to buy individual stocks. Rachel Jones* of Money Hacking Mama says, “Don’t try to pick individual stocks. Investing in a total market index fund is the best for most investors because you’ll have a diversified portfolio of companies. Even Warren Buffett agrees with this!” In the simplest definition, total market index fund, along with exchange traded funds (ETFs), and mutual funds, are preselected stocks that are meant to minimize risks and provide a clear path to reaching investment goals.

It’s confusing, I know, but it helps me to think of it like this: Picking individual stocks is like going to the grocery store and hand selecting all the food you think you’ll need for the week. It could work out well and you buy exactly what you need and nothing else, or you could end up with way too much of something that goes bad quickly, or you may buy too little of one item while it was on sale.

Investing in a market index fund or an ETF, on the other hand, is like buying a meal delivery kit. The portions are already pre-measured for you and the flavors are designed (by a person you’ve never met) to work together, though you have little to no control over what you’re going to get.

Download An Investment App

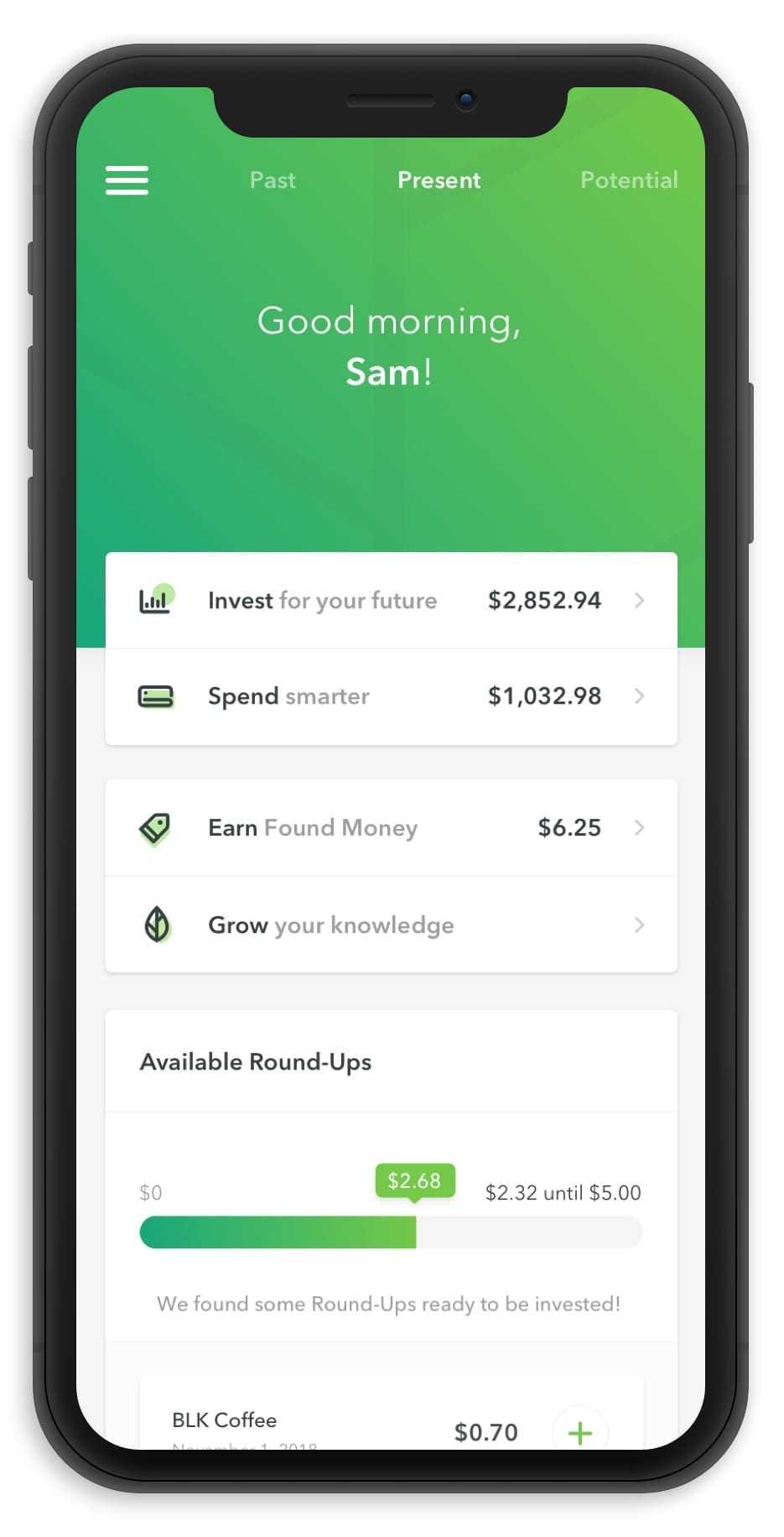

Last year, I started using an app called Acorns, which has proven to be an easy and effective way to invest without even noticing the money leaving my bank account.

“Acorns is without a doubt the easiest way to begin investing. There’s no better or easier way for a novice investor to get started than Acorns!” Allec says. Robinhood is another popular investment app that offers commission-free stock and ETF trading.

Acorns works by having you link your bank account or credit card to the app. If you buy a latte for $4.50, Acorns will then “round up” the purchase to the nearest dollar, and you will be charged $5, in this case. Fifty cents then goes directly into your investment account. From there, your investments are “diversified across more than 7000 stocks and bonds, and Acorns automatically rebalances your portfolio to stay in its target allocation,” according to the Acorns website.

Allec recommends larger platforms, like Wealthfront, Betterment or Stash for saving larger amounts of money. The three apps are “robo-advisors,” Allec explains, that will make your investing much simpler.

Think Long-Term

I will admit that I’m guilty of thinking of my Acorns account as a piggy bank that I draw from when I want to buy something fun, but that’s kind of a terrible strategy.

“Investing should be a long-term strategy. Plan to put your money in and let it grow over time,” Jones says. “Don’t sell if the market goes down. Remember: buy low, sell high. If you sell when the market goes down out of fear, you will be selling low.”

*Last name has been changed.