While words like “budgeting” and “investing” can stir up unease and even anxiety in the minds of many, in these uncertain times it is now more important than ever that we budget and invest. We all strive for financial literacy but in practice, managing our money is not always so clear cut. But if you are looking to take control of your personal cash flow and are not quite on board with hiring a financial adviser — or just happen to want one that is just a click away — there are a number of personal finance apps worth downloading.

The best personal finance apps give us clarity about our finances, helping individuals track expenses, stick to a budget, and make informed investment decisions. They take the tedium out of staying on top of your money — gathering everything into one place so you can get a concise look at what is coming in, what is going out and why. In fact, many finance apps can actually make money management, dare I say, fun.

Determining which app best suits your needs and lifestyle depends on your current financial situation and your long-term goals. Below we have rounded up the nine best personal finance apps to manage your money—and make it work for you.

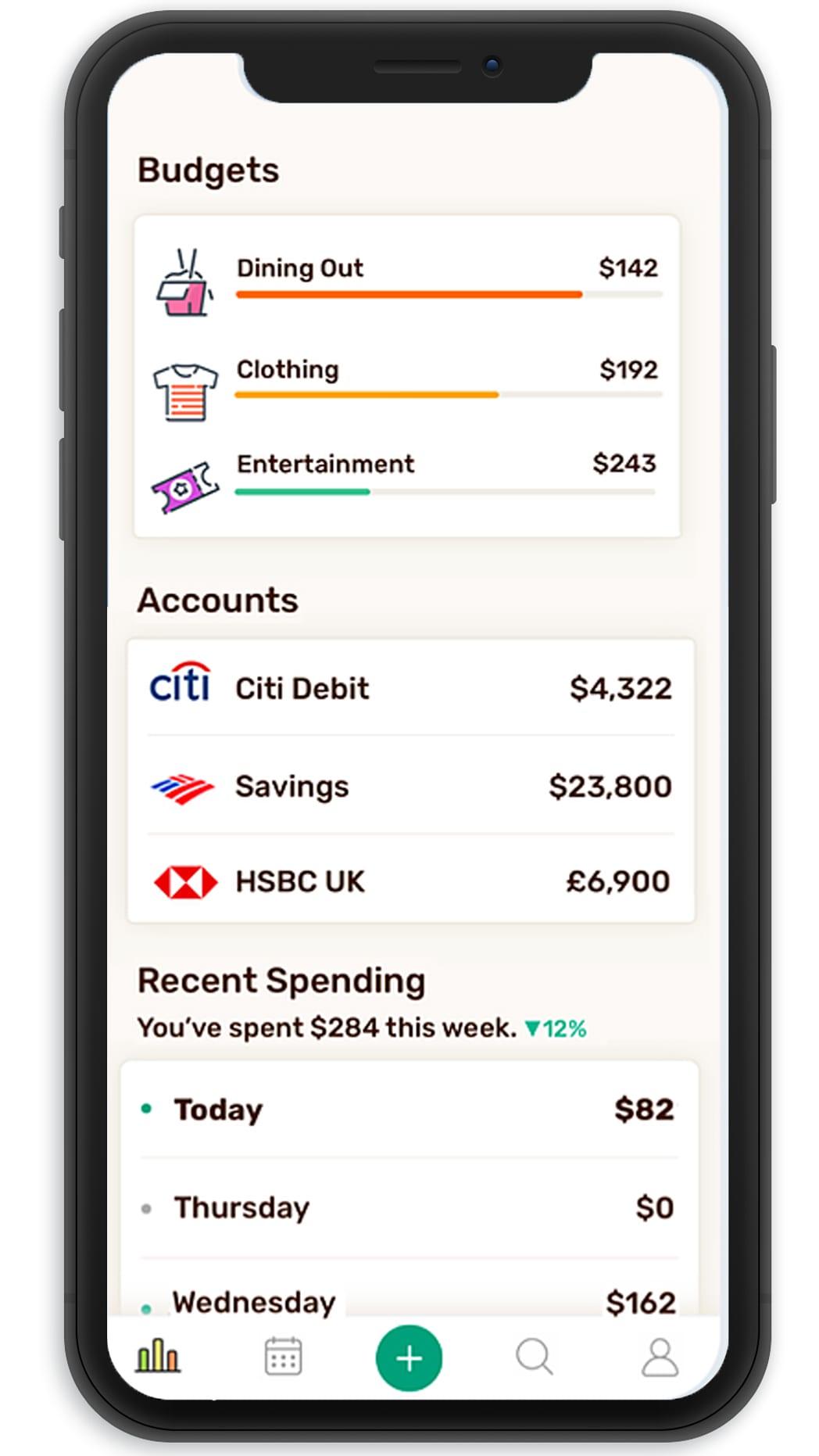

Mint

We would be remiss not to kick off our list with the current market leader in finance apps: Mint. The all-in-one budgeting app is the best overall option if you are just getting acquainted with managing your personal finances or simply want to have a better picture of your money — for free. Mint links to your bank, loan and credit card accounts to aggregate your finances, tracking incoming and outgoing money and presenting all of these channels in one place. It classifies your spending into categories to give you insight into where you may be overspending, so you can strategically cut back and learn to stick to a budget.

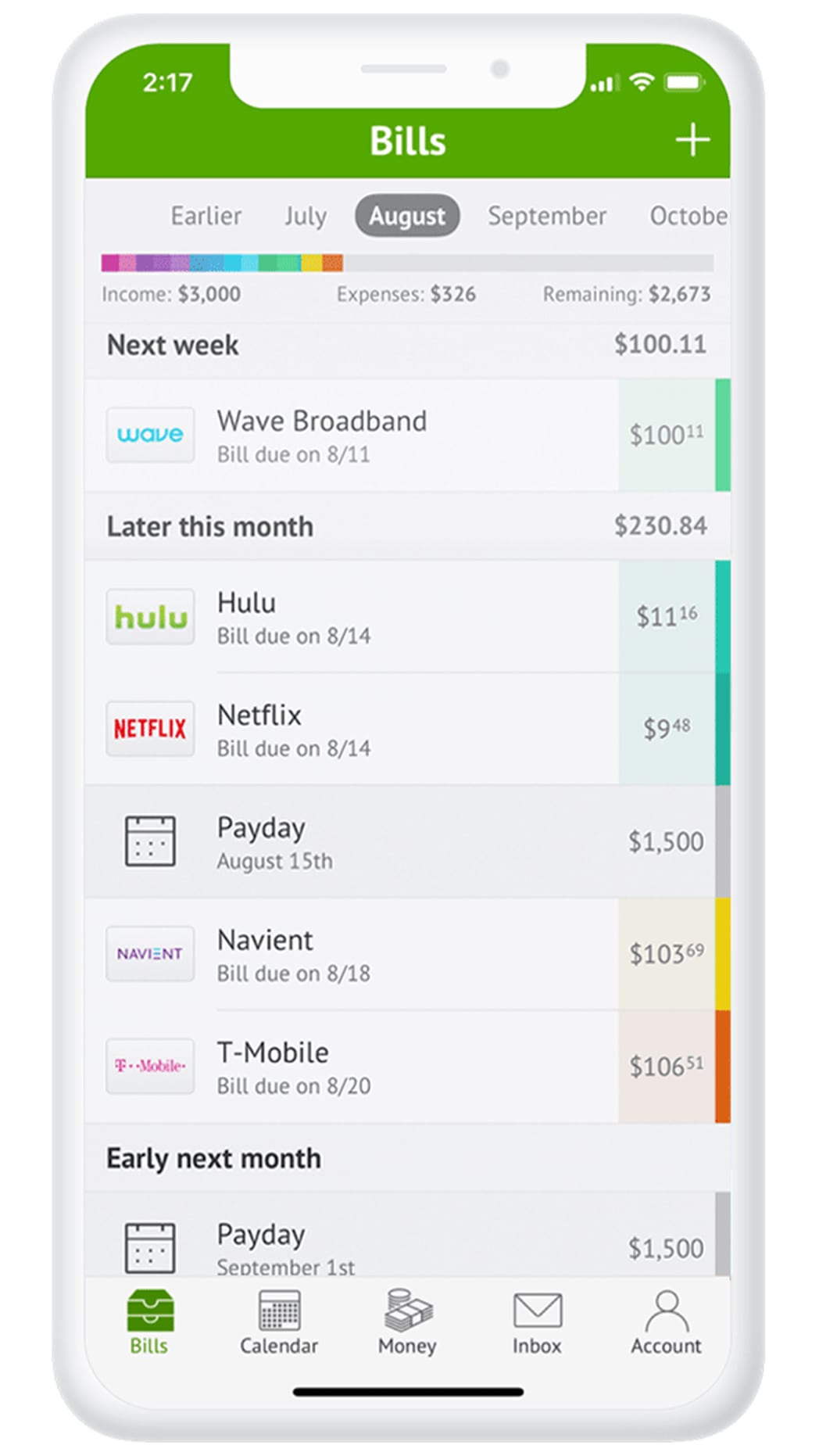

Prism

Paying bills can be one of the most headache-inducing aspects of managing your finances. Between automatic payments that sneak up on your bank balance and paper notices that get easily buried on your kitchen counter, calling bill paying “messy” is an understatement. That is where Prism steps in. The best app for paying bills, Prism automatically tracks all of your bills and organizes them into a calendar or list, then allows you to schedule payments within the app or sends you due date reminders to help prevent late payments. Prism boasts more billers than any other app on the market, with over 11,000 billers across the country. Beyond making sure you never miss a payment again, Prism eliminates the hassle of logging into multiple accounts to pay all of your bills.

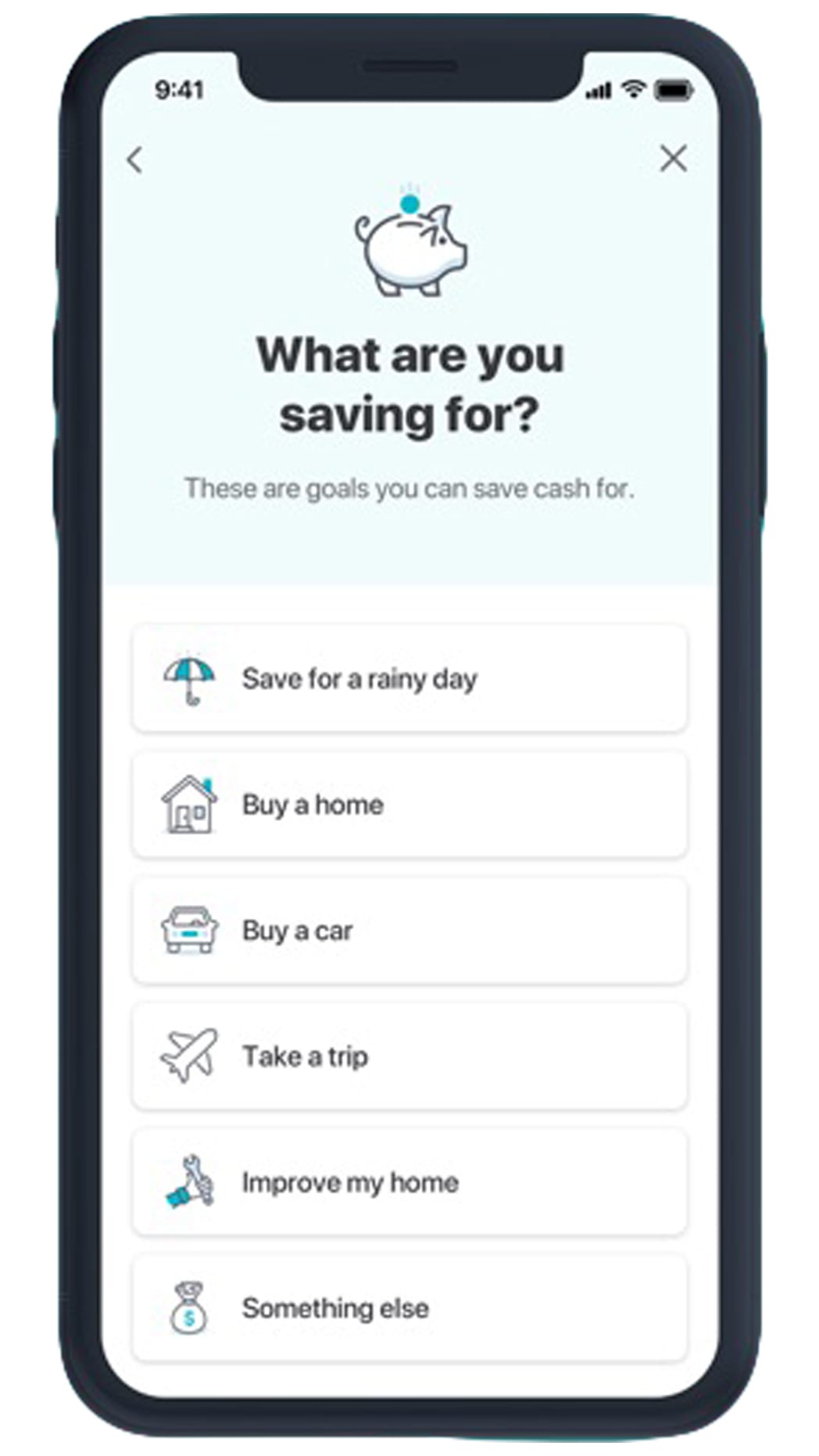

Albert

Price: free for standard features; pay what you think is fair for Albert Genius (Albert recommends at least $4/month)

Price: free for standard features; pay what you think is fair for Albert Genius (Albert recommends at least $4/month)

Despite our best efforts, putting away money is not always easy, so Albert offers a low-effort way to gradually add money to a savings account without your even noticing. Once you have connected your financial accounts to the app, Albert audits your financial status, analyzing your income, spending, and overall financial health by providing a financial checkup score. Using proprietary algorithms, it assesses how much you can safely save each month, then automatically transfers a set amount of your choice or random amounts anywhere between $25 to $100 directly into Albert Savings. The “set it and forget it” approach means you will hardly notice the withdrawals but will see your savings account grow. Albert also suggests a budget knowing your predicted income and bills and alerts you to recurring fees or significant purchases and warns you if you’ve overspent. You can also level up and get Albert Genius, which pairs you with a team of financial experts.

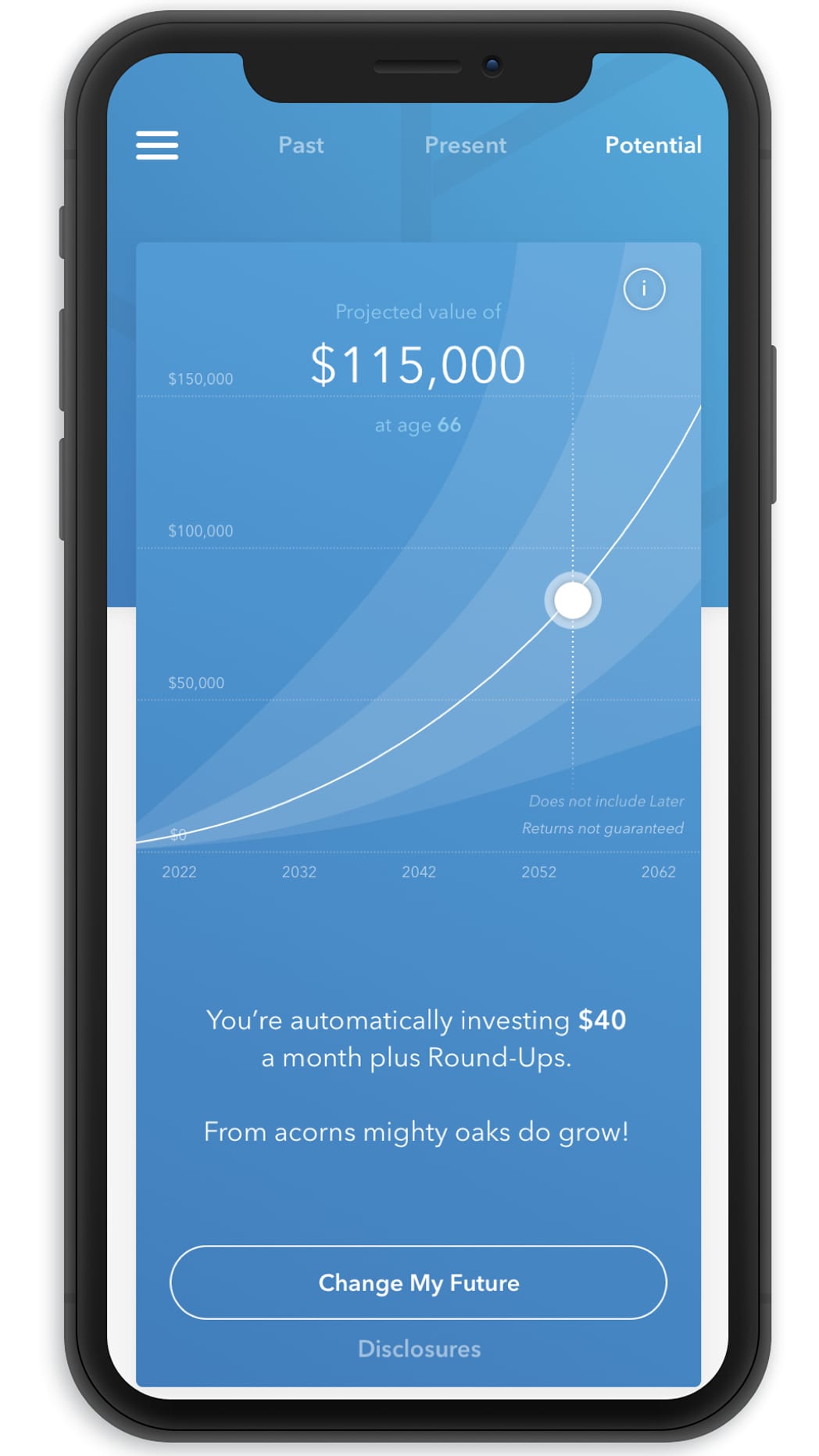

Acorns

Price: $5 to begin investing then $1/month; free to college students for one year.

Price: $5 to begin investing then $1/month; free to college students for one year.

If you are looking to not just put money aside but begin taking baby steps to put your money to work, Acorns is the best app for easy, automated saving. Once you link a credit or debit card to the app, every time you make a purchase with that card, Acorns rounds up the total to the nearest dollar and automatically invests the difference in one of five ready-made portfolios of low-cost exchange-traded funds (ETFs) that you select based on your risk preference. Basically, your pocket change is being put to work essentially without your knowing, making investing painless without your really noticing the difference.

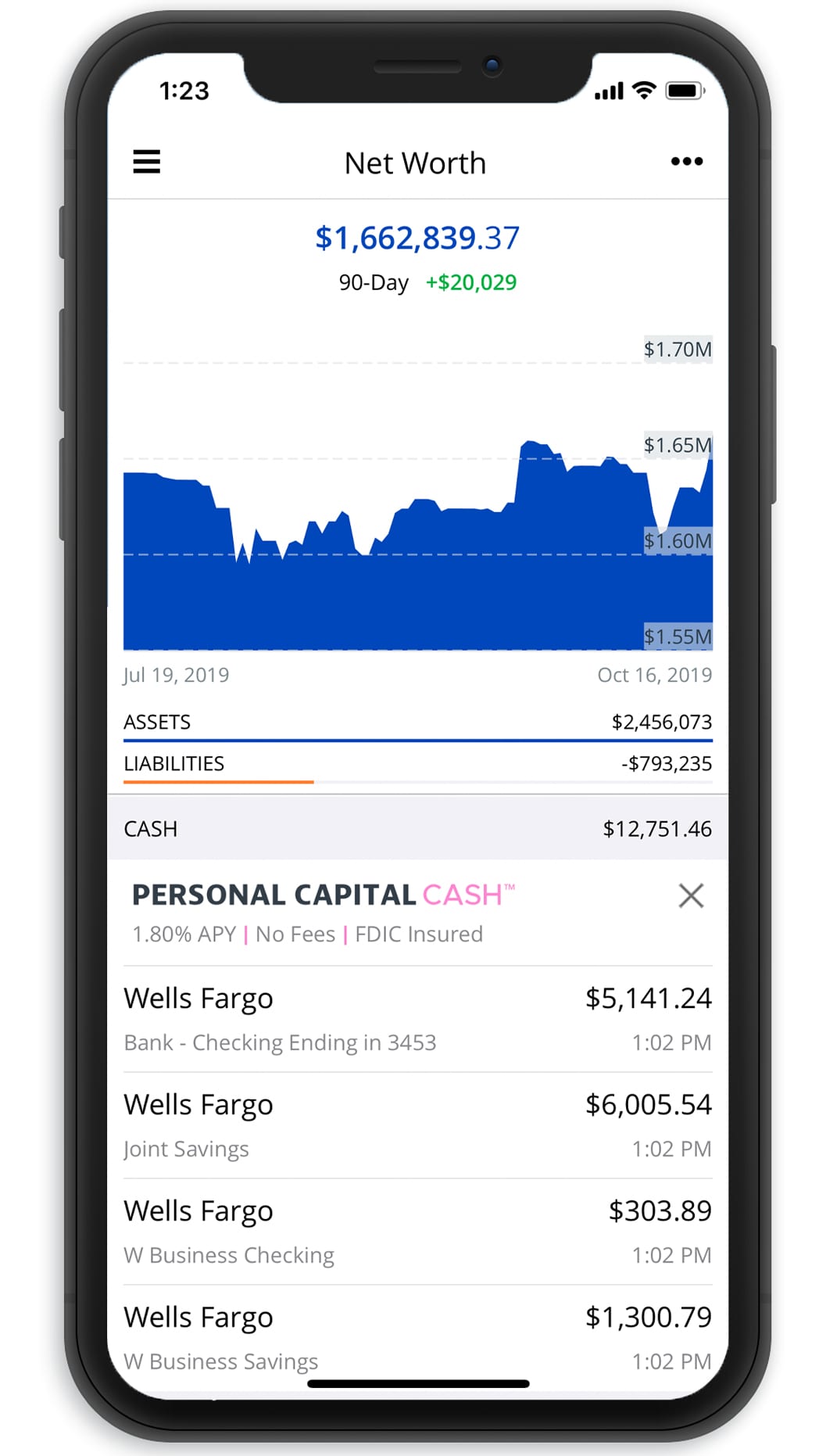

Personal Capital

Price: free; however, you have the option to purchase a premium version for more personalized care

Price: free; however, you have the option to purchase a premium version for more personalized care

For more serious investors, Personal Capital is the best wealth management app on the market. The app allows you to monitor your net worth in real time, integrating over 14,000 financial institutions, and create charts for spending and savings and compare your budget from different time periods. For those actively looking to grow their wealth, Personal Capital offers free investing tools to monitor the Dow Jones, S&P 500 and related fluctuations in your personal holdings in order to optimize your investments. It even tells you when you might want to pull out of a particular investment and put your money elsewhere.

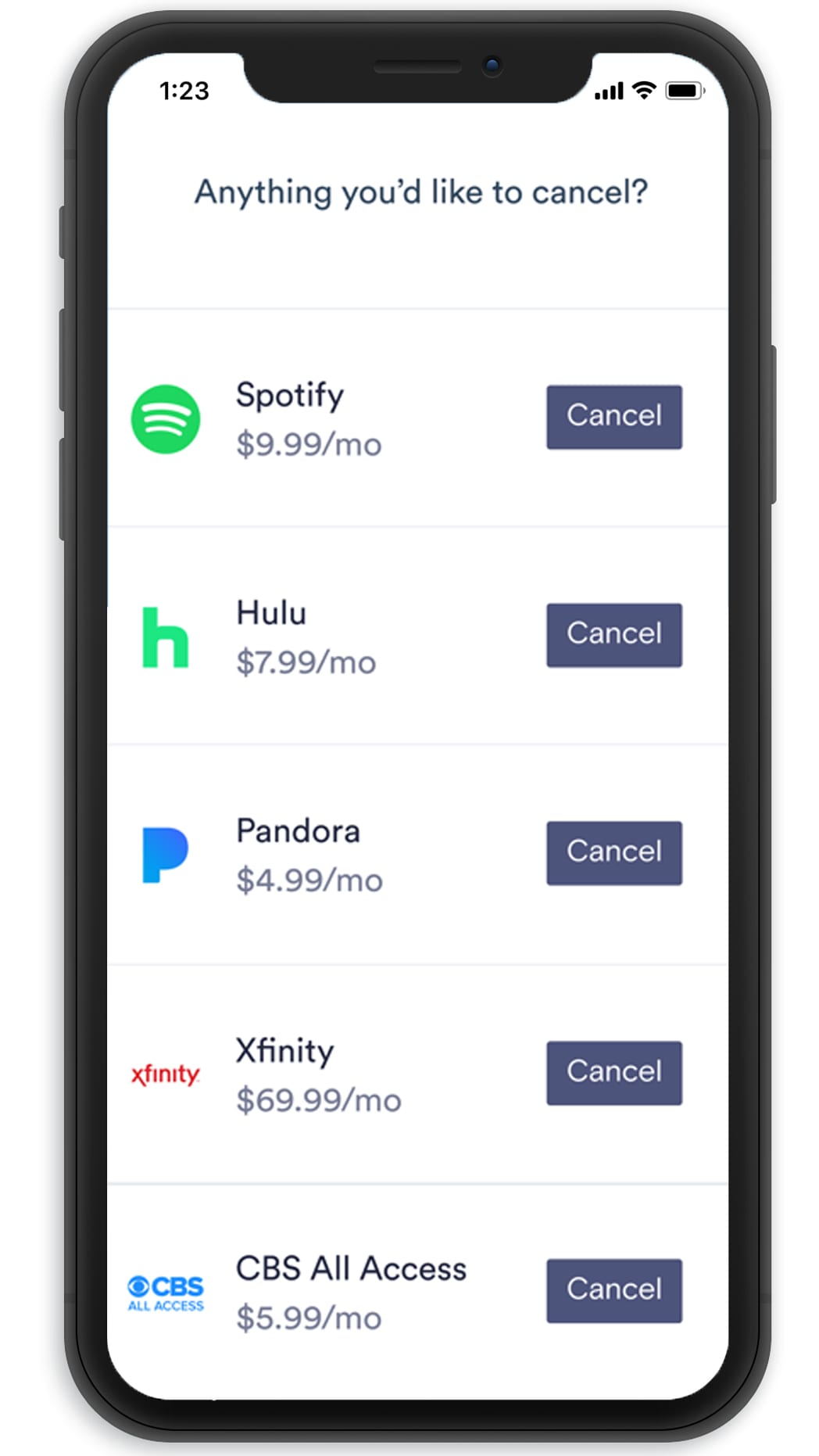

Clarity

Having trouble figuring out where your money is going each month? As the name suggests, Clarity gives you more clarity about your financial health, especially when it comes to unnecessary spending. In a series of tiles that are easy to scroll through, the app tells you how much you have spent in the last few days (and calls out if it is high for you), presents a list of your transactions, offers charts of income versus spending, spending in different categories and a graph of recurring expenses. Clarity helps you identify recurring expenses, such as subscriptions or memberships, that you are not really using, so you can cancel these accounts. Additionally, the app analyzes your spending behavior to give advice for improving your overall financial health.

Wally

If you are required to track expenses for work projects or self-employment, Wally has the power to streamline and simplify your whole routine. One of the best expense-tracking apps out there, Wally allows you to take photos of your receipts and even fills in additional info using your geolocation, if you allow it, so you no longer have to manually log your expenses at the end of each day (or days later when you are rummaging through your work bag to find old receipts).

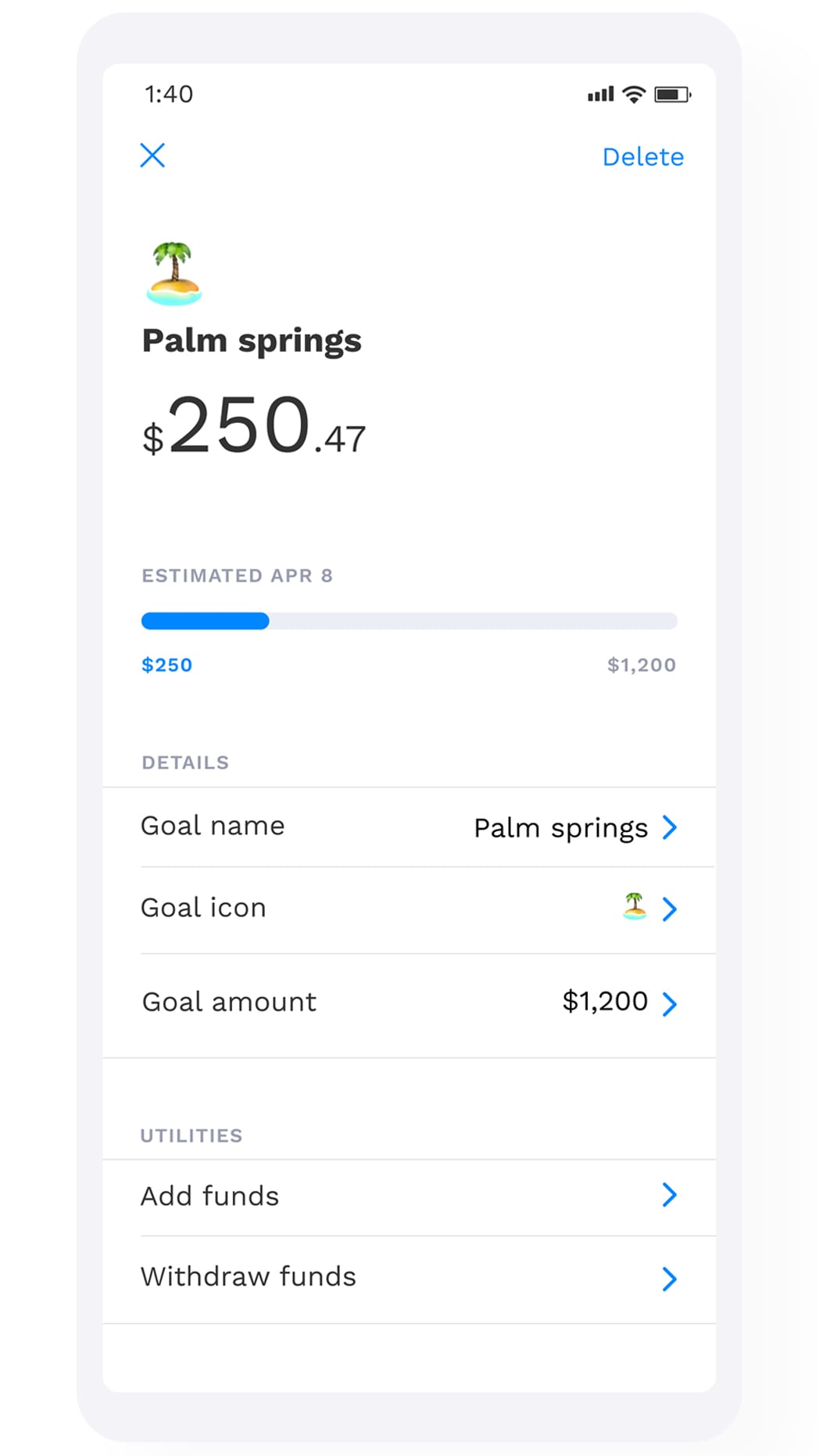

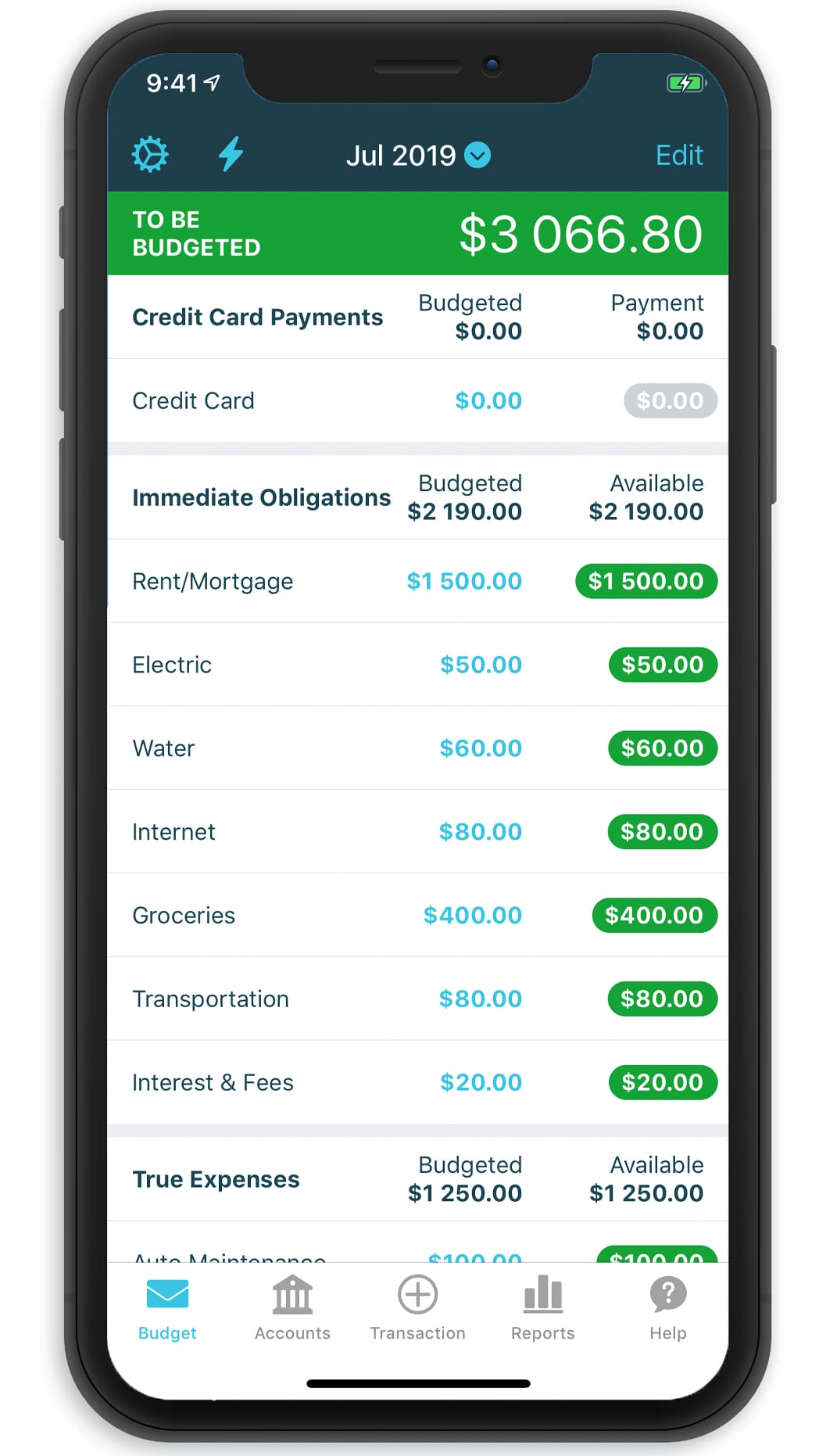

You Need A Budget (YNAB)

Price: After a 34-day free trial, the app costs $83.99/year; free for a year for college students

Price: After a 34-day free trial, the app costs $83.99/year; free for a year for college students

For those needing to get out of debt and who require a more hard-hitting approach to reeling in their spending, YNAB is the best app for the job. The no-nonsense app will drill in solid budgeting practices and even offers newsletters, videos and live workshops on topics like mastering credit cards and aggressively paying down debt. The YNAB approach is premised on four rules for successful budgeting: give every dollar a job, embrace your true expenses, roll with the punches and age your money (meaning, you shouldn’t be living paycheck to paycheck). While much attention is given to the immediate, YNAB also allows for looking beyond your monthly budget to plan for future expenses and even gives tips for achieving your goals.

Stash Wealth

https://www.instagram.com/p/B_TNVKxgtOT/

Price: Individuals and couples pay a one-time fee of $1,497 and entrepreneurs can pay a one-time fee of $1,997 for additional plan features

Not an app, but still created for the digital-native set, Stash Wealth is a virtual financial planning and investment management firm. The firm offers its services to a subset of millennials it refers to as “H.E.N.R.Y.s” which stands for “High Earners, Not Rich Yet.” The mission statement is to allow successful 20- and 30-somethings to keep their lifestyle while still planning smartly for their future. Through its virtual planning services, Stash Wealth helps clients define their long-term goals and present-day priorities, then reverse engineers a game plan to strategize how they can put their money to work in the most efficient way.